Sri Lanka's BOP within a World in Transition

Given the complexity of the global transition that has been triggered by Trump’s policies, there is no way to be confident about what the global economy would look like in the next few months. In our view, what that means for our outlook for Sri Lanka’s balance of payments (BOP) is more nuanced than just factoring in the loss of goods exports to USA due to the 44% tariff hike.

While in the near term, the direct impact of the tariff shock might dominate changes in the BOP, as the year proceeds, we are likely to see the second order impacts coming into play and even dominating the overall BOP impacts. This report takes a look at what these varied factors can be and the scenarios we have for the BOP.

The full note sent to clients includes a more detailed exploration of these questions. A few limited extracts of these are given below -

The direct first order impact from Trump’s tariffs

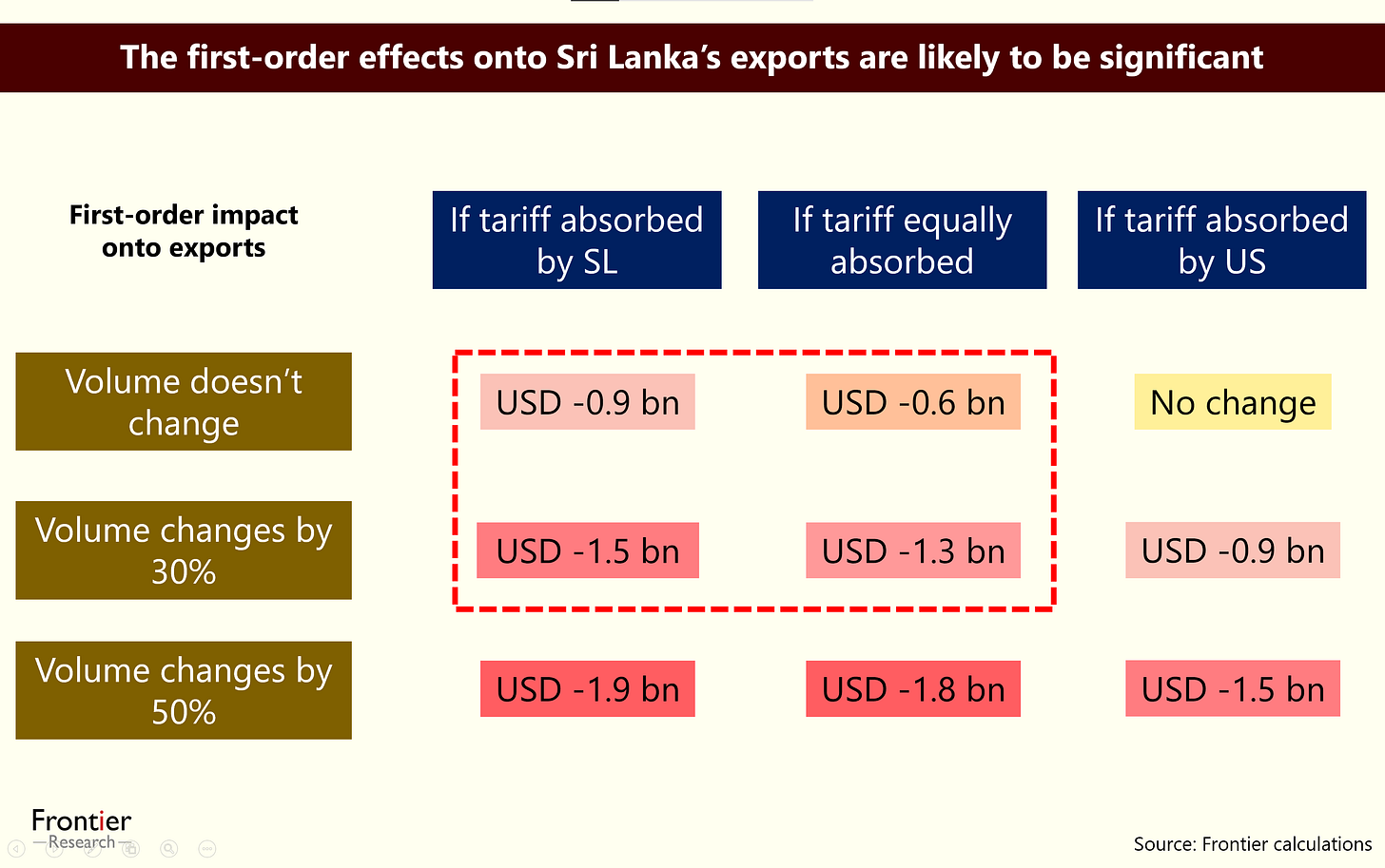

On the surface, the massive 44% tariff hike should imply that Sri Lankan exports to the US should see a contraction. However, the reality could be affected by factors such as which party in the supply chain takes on the cost of the tariffs and the actual change in volume of exports. This leads to a few scenarios -

If Sri Lankan manufacturers absorb the full tariff cost

If the tariff costs are fully covered by foreign entities

The second order impacts from Trump’s tariffs

However, we cannot just pencil in a reduction in export earnings into the pre-tariff BOP outlook. There are a few key factors that can affect this situation, especially since the tariffs are not just on Sri Lanka but on the world.

Falling raw material and intermediate imports – As exports fall, the requirement to import raw materials and intermediate imports will fall as well.

A global slowdown in demand will affect all exports – While the 44% tariffs will affect exports to the US, a global slowdown will mean all of Sri Lanka’s exports, and even tourism and remittances, can get affected

Global price changes can go both ways – Varied price changes, in global commodities and currencies, can affect the import and export numbers for varied imports and exports for Sri Lanka

Outside of these more obvious changes, a world going through lower trade and a complete transition, can see other unexpected changes that can impact the BOP, in both direct and indirect ways.

Two broad pathways for the global economy from here

As we highlighted in Frontier Global Watch – The Global Economy in Transition the current global economy is structured between the consumer demand generated by US deficits and the manufacturing capacity of China that keeps it in surplus. If we understand the current moment as one where this system is fundamentally changing, that will inevitably mean big changes.

Outside of a scenario where things return to normal, we think that there are two broad contexts that can be applied.

Scenario of falling global prices - This scenario maps closely to our overall scenario where “US deficits shrink, but Chinese surpluses stay strong". If this scenario tips into recession, this is what we called a “deflationary recession”.

Scenario of rising global prices – This scenario maps closely to our overall scenario where “Both US deficits and Chinese surpluses shrink". If this scenario tips into recession, this is what we called an “inflationary recession”.

Outside of these, it’s also possible for some parts of the world to see rising prices and other parts to see falling prices. Understanding broadly what these pathways mean can in turn help us understand the potential impacts on the BOP outlook for Sri Lanka, even in the context of such divergent pathways.

What would a scenario of falling global prices mean for Sri Lanka?

The main benefit of such a scenario is the falling price of oil imports. Right now, we are seeing a significant reduction in crude oil prices as the market factors in the potential for significantly lower global demand conditions. Certain producers with lower marginal costs have also increased output to increase their market share during a volatile period. If lower demand conditions dominate the market, then other commodity prices would also continue to fall lower in the near term, cotton, copper, iron, chemicals, fertilizer, etc.

Falling fuel costs are a big potential FX saver

Global currency depreciation can push input prices lower

These two points could combine together as well. Even in other intermediate imported inputs like cotton yarn, plastics, chemicals, the reduction in commodity prices can help contain import costs. As a result of the import cost reduction, the actual net export loss would be less.

What would a scenario of rising global prices directly mean for Sri Lanka?

While the ongoing market moves indicate falling commodity prices, the eventual outcome could be different if the policy responses by major economies is to respond to Trump’s tariffs in varied inflationary ways. This could be through significant currency movements, retaliatory export controls, specific regional trading arrangements, to name a few. Cutbacks in supply as a result of firms rapidly cutting back on output to deal with the ongoing volatility and curtail losses can also contribute to this scenario.

What would an outright global recession mean for Sri Lanka?

A global recession would support the downward movement in commodity prices, since it would mean lower demand conditions for a longer period of time. Lower import costs could be an immediate gain, provided policy reactions don’t cause inflationary impacts.

But the impact won’t be limited to exports. Tourism and remittance earnings could be lower than was earlier anticipated for 2025. Of course, Sri Lankans could also reduce their travel abroad, so that could mean a lower net impact.

What does all this mean for the current account?

All of this implies that Sri Lanka’s current account balance for 2025 could remain within the baseline scenario we have assumed so far. This is because the foreign earnings contraction can be largely offset by the reduction in import costs, especially in the next few months.

Beyond this baseline, depending on actual developments the surplus or deficit could be higher – for example crude oil prices could fall more than expected or tourism could end up being weaker than expected.

Can Sri Lanka count on financial flows in a volatile global environment?

Typically, in a global recession, countries like Sri Lanka can see capital outflows especially as investors flee to safe haven assets, including US Treasuries. The rate cuts that follow recessions tend to create financial conditions that enable developing countries to then attract capital subsequently. But the scale of global transitions underway can complicate decisions in terms of what assets count as safe havens. As we have noted earlier, there has been an accumulation of savings parked in financial center such as Singapore and Hong Kong.

As a result, we think that the overall external BOP balance situation can remain within our broad previous expectations. But a higher-than-expected current account deficit, for instance, might erode the surplus or even require more foreign asset drawdowns either by the commercial banks or CBSL.

Frontier usually restricts sharing of their research and advisory notes. In exceptional situations, such as the currently volatile global environment, we are open to limited sharing of our work. We just ask that you inform us ahead of time of such a limited sharing.

For limited time access to the full note, please reach out to us on research@frontiergroup.info. Clients who have access to Frontier Athena can visit athena.frontiergroup.info

(Frontier Research is a Colombo-based firm that engages in macroeconomic research and advisory for corporate and investment clients on Sri Lanka, South Asia, and South East Asia.)