The Global Economy in Transition

Trump’s tariffs are undoubtedly going to be remarkably consequential to both the world and the Sri Lankan economy. In two notes Frontier sent out to clients last week, we gave both our initial thoughts on how to think through the situation, and a more action oriented series of points for Sri Lankan players for this world. In both these, we gave our view that the extent of the actions is so large that they indicate the serious possibility of a “fundamental change” in the global economy.

For Frontier, the idea that the global economy is transitioning from one system to another is hugely impactful. Even if the probabilities are not 100%, the consequences it would bring are incredibly high. This note we’re sending is to lay out our understanding of this concept in more detail, so that our clients can remain ahead of the curve.

The full note sent to clients includes a more detailed exploration of these questions. A few limited extracts of these are given below -

How did the global economy work before the tariffs changed it?

Frontier’s framework for understanding the world economy is straightforward. We see the world as one where China produces, the US consumes, and the rest of the world intermediates between these two pillars. This is a world where the US runs large deficits, China runs large surpluses, and the rest of the world runs smaller surpluses and deficits in between.

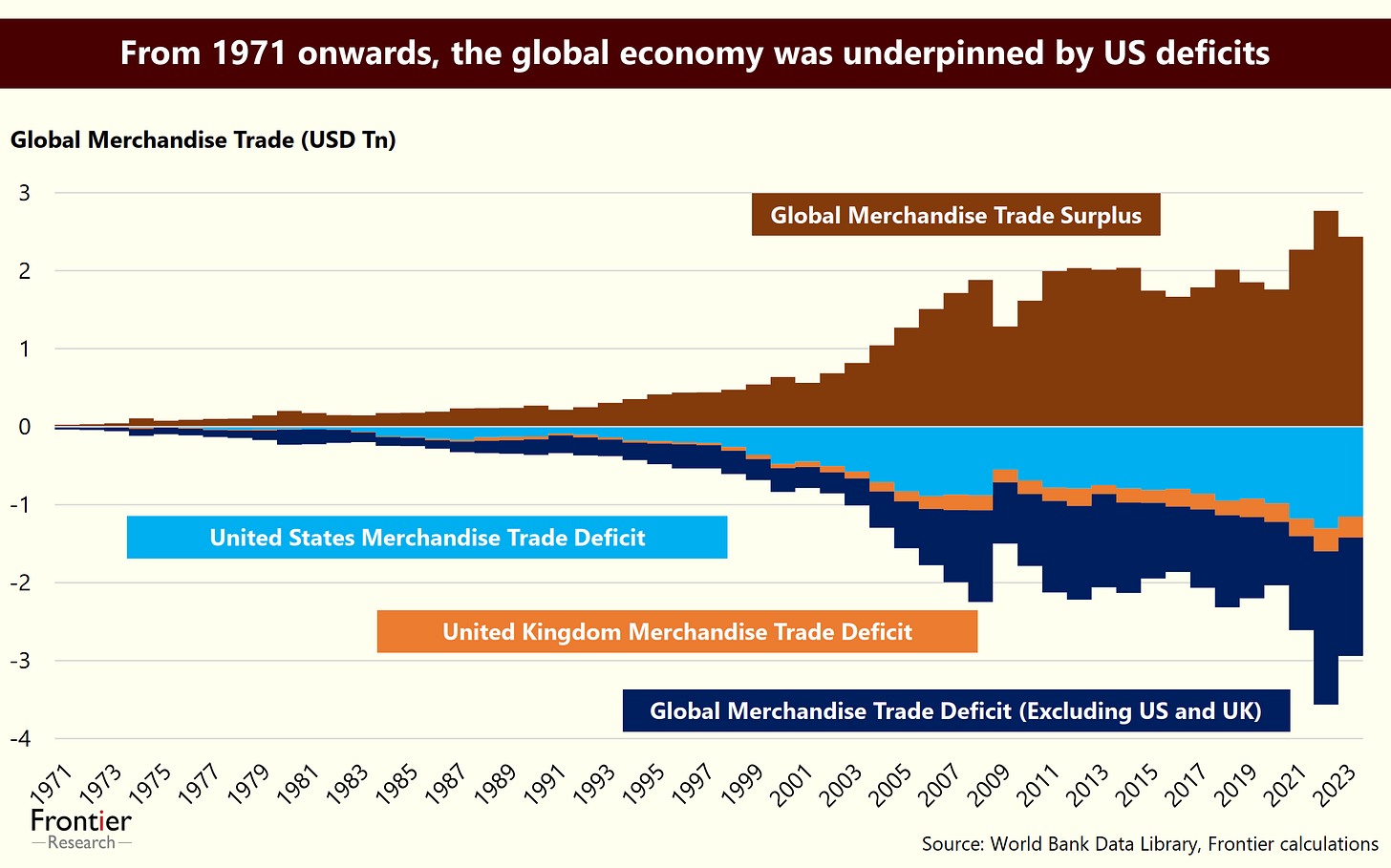

The US deficits – The fundamental driver of the global system since 1971 in our view, is the external deficits run by the US. This has helped the US become the world’s consumer, buying from varied producing nations of the world.

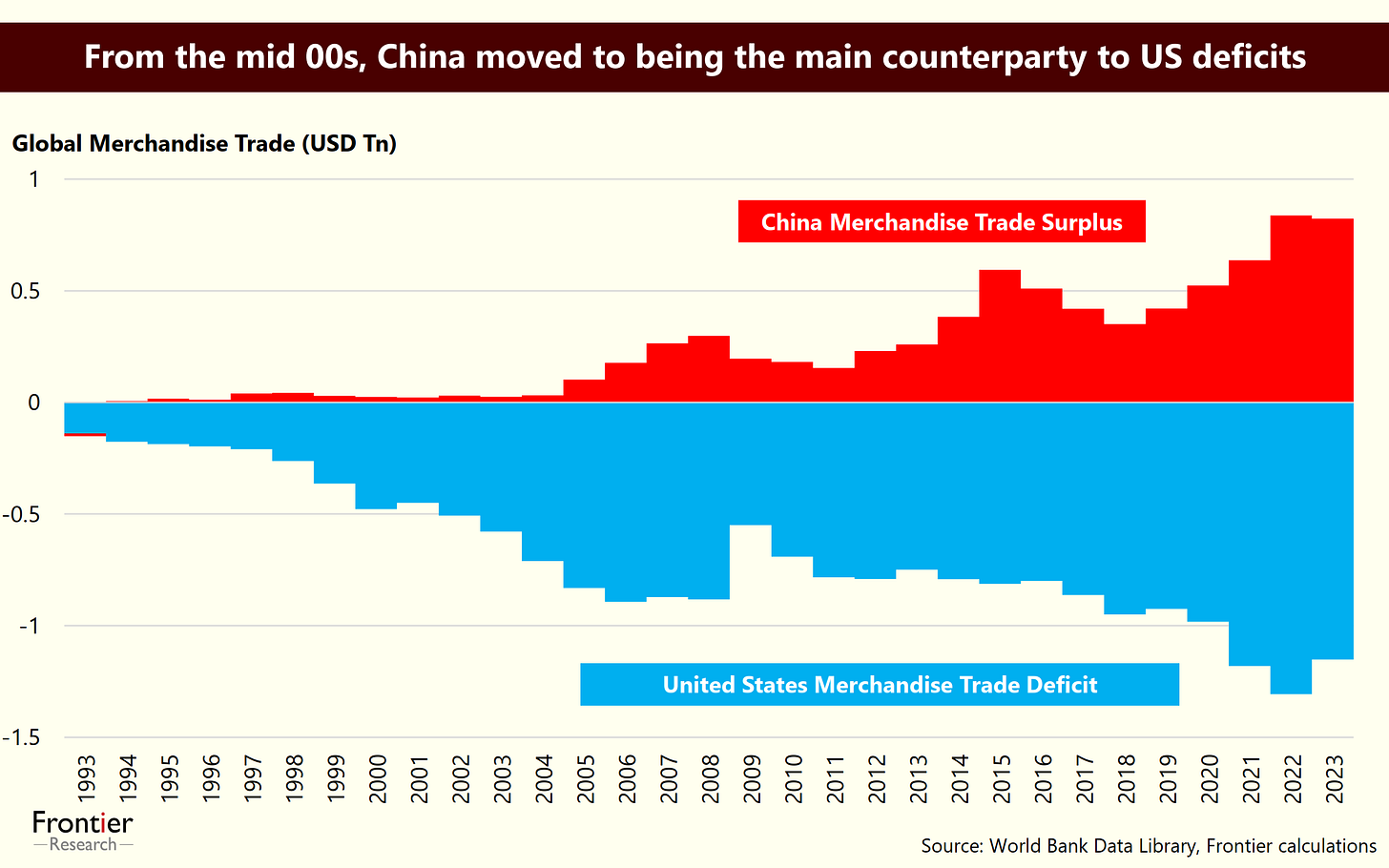

The Chinese surpluses – Starting from the mid-1990s, but clearly from the mid-2000s, China has become the single largest producer nation that sells to the US. Over time, Chinese surpluses have essentially ended up balancing US deficits.

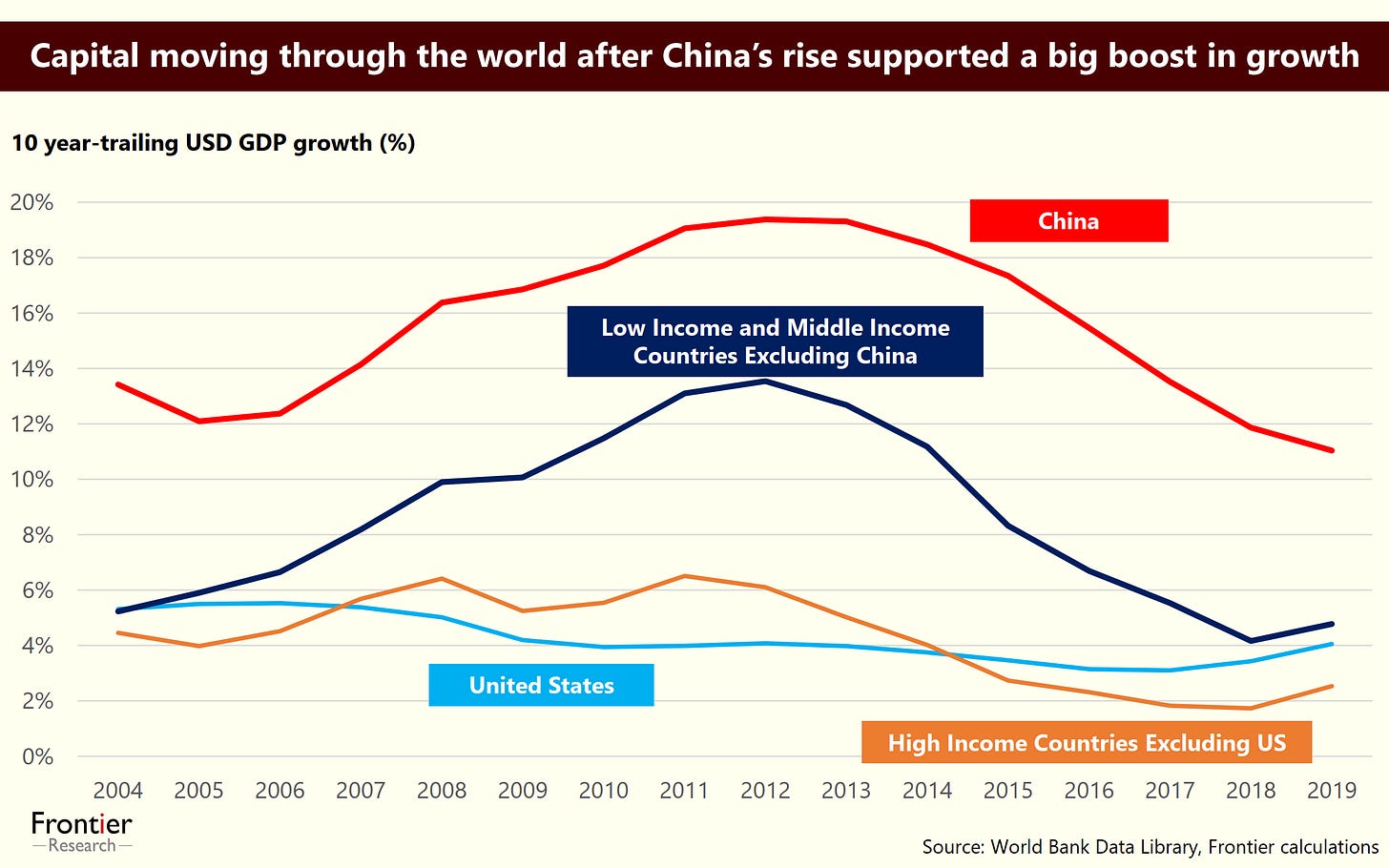

The rest of the world – For the rest of the world, they have ended up working as intermediaries between these two countries. Especially from 2005 onwards, this meant a lot of trade and capital flowed through the developing world, creating a big growth period.

The change in the global economy can be hugely impactful

The tariffs put on by the US administration end up fundamentally challenging this structure of the global economy in our view. Even if the tariffs are reversed to some extent, we think the costs that have already come to the global economy incentivizes the world to move away from this system.

For the US – If the US wants to fundamentally change a core part of their relationship with the world, that suggests that the world should be ready for smaller US deficits in the future.

For China – If the US runs smaller deficits in the future, that means China either has to reduce their surpluses or find new markets to sell to. Both of these will mean big changes to the rest of the world.

For the rest of the world – Outside of the direct impacts of US tariffs on their exports, the context of either a massive global trade slowdown or a complete reordering of which countries consume can be massively consequential.

What are the ways the global economy can move in the future?

From Frontier’s viewpoint, there are 4 broad ways that we think the current global system can move.

Both US deficits and Chinese surpluses shrink – This is a scenario where the US reduces consuming from China and the rest of the world and China reduces selling to the US and the rest of the world.

Both US deficits and Chinese surpluses stay the same – This is a scenario where most of the measures taken right now end up largely reversing, and the world returns to one that is fundamentally of US deficits and Chinese surpluses.

US deficits shrink, but Chinese surpluses stay strong – This is a scenario where the US reduces the consumption it does from the rest of the world, but China still pushes out more and more production of goods.

US deficits stay strong, but Chinese surpluses shrink – This is a scenario where the costs and shock of the immediate moment pushes China into taking a decision to restructure its economy, and going through the pain that’s necessary. However, in this scenario, the US ends up reversing enough of the tariffs or returns back into running deficits and running the usual consumption economy.

Both scenarios 3 and 4 are ones where you have significant imbalances across the world, with some areas growing faster, and some seeing long-term declines. Across all 4 scenarios, one particular measure we see is the potential for regional integration.

How does this affect an actual player in Sri Lanka?

The direct and indirect impacts of the current tariffs changing have been extensively covered, including in our recent reports. However, the cost of a changing global economy can be far larger and far more impactful.

Prepare for volatile costs in the short-term

Don’t put all your cards in on negotiations

Retaliation and response of other countries can determine the short-term

Watch out for what China does

Watch out for what is going on in Europe

Frontier usually restricts sharing of their research and advisory notes. In exceptional situations, such as the currently volatile global environment, we are open to limited sharing of our work. We just ask that you inform us ahead of time of such a limited sharing.

For limited time access to the full note, please reach out to us on research@frontiergroup.info. Clients who have access to Frontier Athena can visit athena.frontiergroup.info

(Frontier Research is a Colombo-based firm that engages in macroeconomic research and advisory for corporate and investment clients on Sri Lanka, South Asia, and South East Asia.)